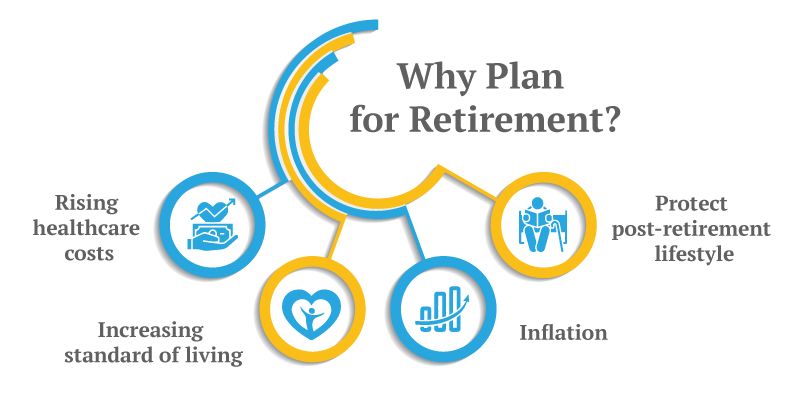

Ideally, you should start retirement planning as soon as you start your first job. But it’s never too late to start. We Create a checklist to map out a route to your retirement also List every goal you need to meet to retire on time and with enough income and side investments.

Retirement planning allows you to create financial security while you’re working

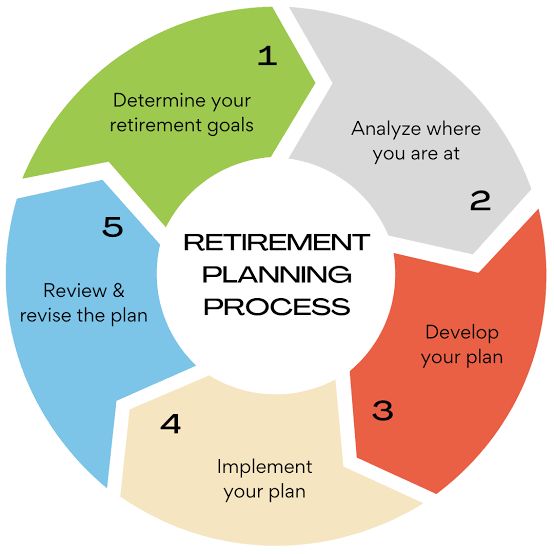

Retirement planning involves determining retirement income goals and what's needed to achieve those goals. Retirement planning includes identifying income sources, sizing up expenses, implementing a savings program, and managing assets and risk. Future cash flows are estimated to gauge whether the retirement income goal is possible.

You can start at any time, but it works best if you factor it into your financial planning as early as possible. That’s the best way to ensure a safe, secure—and fun—retirement. The fun part is why it makes sense to pay attention to the serious and perhaps boring part: planning how you’ll get there.